2010 – A Really Good Year

Everyone else is doing end-of-year round-ups and it’s inspired me to do one too. Feel free to skip if you don’t like introspection ;)

While my life as a whole has been up and down (mostly up but some deep downs), 2010 has been a fantastic year from a simple/DIY living point of view.

Growing

Our first growing season in our new house, this year was one of experimentation. We had fresh produce from the garden from March through to October – and have a cupboard full of preserved goodies as well as potatoes in store. I’ve written about our growing successes and failures before – our overall output was disappointing but my, my, I learned so much. I’m pretty jazzed by the potential of what we can achieve now we know more about the conditions etc.

Chickens

Our first four chickens arrived in June and we got another four (which soon depleted to three) in November. They’ve been ace!

They’re a lot of fun – such personalities! – and the egg output has been awesome. From the day they arrived in June until the middle of December, the first four provided about 3.6 eggs a day (ie, most days one each but sometimes just three between the four of them) – they’re still laying now just less than that (especially as one has entered an early moult). The new girls have yet to start laying but hopefully they’ll start soon – and that’ll provide cover for when the rest of the originals going into moult.

Aside from the extra winter workload, I’ve been stunned by how little work they are – food & water are topped up once a day (they always have more than enough), quick visual inspection of the coop every day-ish (remove any giant piles of poo/top up straw & shavings as appropriate) and a full clean out once a week. It’s an hour a week in total, max. I do typically spend more time with them though – because as I said, they’re so much fun. Their arrival has been one of the highlights of 2010 for me.

Cooking

Read MoreAn expensive lesson

As I mentioned in my “spending during my no spend week” round-up, our boiler broke and had to be fixed this week.

It stopped working last Sunday – we thought it was just a sensor playing up but when the plumber replaced the thermostats on Tuesday evening, it still didn’t fix the problem so he had to come back on Saturday – replaced another thing (essentially a £35 washer on the diverter valve), went through a whole load of troubleshooting then replaced something else, something more expensive, something electronic. And you know what? if we’d acted earlier, we could have avoided all of it.

We hadn’t had the boiler serviced in the year and a bit since we moved in. We knew we should but didn’t get around to it.

A few months ago, we noticed that there was something leaking very, very slightly (the washer thing on the diverter valve) but we pretty much ignored it – we’d get it fixed when we got it serviced and getting it serviced was on “to do at some point” list.

Those with a speedy intellect may have made the leap that, with hindsight, is painfully obvious. The leak dripped onto electronic control board and after a couple of months of occasional dripping, the board decided it had had enough.

After finally fixing it, the plumber did a service – he thought it was possibly the first service it had ever had, in its eight years of use, not just our 15 months here – and between that, all the parts & the rest of his labour, it cost us £292 – and left us without any central heating or hot water for a week in the middle of winter. (Our woodburners did a great job of keeping us warm in the living room and office, but the rest of the house was chilly and felt increasingly damp as the week went on.)

If we’d had a service and had the diverter valve thing replaced when we first noticed the drip, it would have cost us about £90 in total. The boiler would also have been running inefficiently because of eight years of build up.

We’ve learnt a very important lesson about maintenance – and about how procrastination can cost you a lot more money in the long run. I really hope we apply the knowledge in the future!

Read MoreSpending during no spend week: week 1

A little background in case you’ve not seen my earlier post: I’m having a no spend “week” – well, a no spend fortnight+, until the end of the year. It was an impromptu idea – I often have no spend days, probably even weeks, without really noticing it but I wanted to have a conscious “no spend” period – and to come at it without any planning/organising has been interesting indeed!

Aside from my acknowledged exceptions (food-to-cook-at-home, food/vets for animals, essential bills, some bus fares and one birthday present), I have spent some money:

- £3.35 on posting a package to my mum. It wasn’t time sensitive – it didn’t have to be there by a certain point or anything – so it could have waited until after my no spend period. But it seems silly to be waiting just on the principle when I would be sending it either way (it’s not like I’d change my mind about sending it like I might about buying something). Equally, the item – a vintage music box I found in a charity shop, matching one my mum already has – could easily have been sent a couple of weeks earlier if I’d been more organised/planned my no spend week better. I could have easily not sent it but I think the important thing is that I took time to consider whether or not to send it rather than just acting without thinking.

- £292 on getting our central heating/hot water boiler fixed and serviced. Sigh. (Strictly speaking, John paid for this, not me, but I wanted to mention it anyway.) It stopped working on Sunday and was finally fixed on Saturday – six days without heat was beginning to make the house feel very cold and damp (our woodburners provide heat in the living room & office but aren’t big enough to heat the whole house). Given it’s the middle of winter, it was more a necessity than a frivolous want – and if we waited, it would have got harder and more expensive to fix over Xmas and New Year. (I’m going to write a post on this soon because it taught us an important, expensive lesson.)

- £3.24 on drinks at the pub on Saturday afternoon. A bit of a frivolous spend this one but it was a social occasion – meeting some people we’d been meaning to meet up with for *ages*. John was going to buy them but I was closer to the bar so I went.

From my exceptions list, I bought the birthday present, spent £4.30 on bus fare and we went to the supermarket for our monthly shop.

This is obviously quite a lot of spending during a no spend week! But it did work to strength my willpower while I was looking for the birthday present. I went into both clothes shops and bookshops while buying it – two key temptation areas for me – but I stayed focused and only looked at the category of things I was likely to buy for my friend, not stuff in general and certainly nothing for me. I also avoided charity shops and bargain shops to avoid the temptation. If I hadn’t been “no spend”ing, I could have easily have spent £50+ at those shops without really wanting or needing to – or even really noticing!

The “no spend” rule has also kept me away from online shopping – I’ve had several “I could just check eBay for that” moments regarding books, curtains and other random things, but I’ve resisted. I’ve also resisted temptation of sale offer emails from shops I like – and unsubscribed from those marketing lists.

We ate out on Thursday night – John’s company’s December meal (which they paid for) – but aside from that, haven’t eaten out or had any take-out. We had talked about having lunch at the pub on Saturday but instead had a bigger breakfast and didn’t need to eat again until we got back.

I’m going to keep going to the end of the year – so another ten days of no spending. From the exceptions list, I’d imagine I’ll need to spend a little on fresh food this week, buy a bag of dog food (which lasts 6 weeks), possibly some money on vet bills (Lily-dog is poorly at the moment – hope it’s just a bug) and a return bus fare to a rehearsal tomorrow night. Hopefully that’ll be it though!

Read MoreWhy are you frugal? Poll update

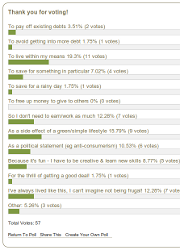

A couple of weeks ago, I set up poll asking what drives people’s frugality.

A couple of weeks ago, I set up poll asking what drives people’s frugality.

Part of the reason I asked is because a lot of frugal living blogs/personal finance sites are really focused around paying off debt. People detail their debts and progress in paying them off in their signatures on every comment/forum post – most of them are well in five figures and one person I saw talked about having US$1million of debt (!!). But that’s not why I’m frugal – and it’s not why a lot of people I know are frugal – so I wondered what it else it could be.

As of this morning, most people who voted were pro-actively frugal – just over 20% of people said they were either frugal to live within their means or to avoid getting into more debt, and just under 9% in order to save for something, mostly something in particular. Only 3.5% of people were doing it to pay off existing debt.

Adding to the proactively frugal number, over 26% are frugal as a side effect of living a simple/green life or for other political/philosophical reasons (such as anti-consumerism or stuff minimalisation), and another 12% said they were frugal so they didn’t have to work/earn as much.

Over 10% said they actively enjoy being frugal – mostly that they have to be creative and learn new skills to live on a tight budget. And another 12% said they’d always been frugal and couldn’t imagine living any other way.

I realise that the results are not necessarily representative of the population at large, even the frugal population at large, just a selection of the people who read this blog and took the time to vote, but I find it interesting all the same. We hear so much about debt – not just when on the personal finance sites I mentioned above but in the media – that it’s good to hear that not everyone is rampantly spending with free abandon.

Thanks to everyone who voted!

Read MoreThings I spotted at the supermarket

Yes, I know I’m having a no spend week/fortnight+ at the moment but one of my exceptions was food because it was an impromptu decision not to spend anything and I knew we’d be off to the supermarket this week for our once-monthly shop. If I’d planned the week more, we’d have gone last week but we didn’t really want to leave it any later than this week because it’ll be crazy busy next week and the week after.

Yes, I know I’m having a no spend week/fortnight+ at the moment but one of my exceptions was food because it was an impromptu decision not to spend anything and I knew we’d be off to the supermarket this week for our once-monthly shop. If I’d planned the week more, we’d have gone last week but we didn’t really want to leave it any later than this week because it’ll be crazy busy next week and the week after.

So, anyway, during our visit to the supermarket last night, I spotted the following things:

- 1kg of their normal (not best or basic) own-brand carrots cost 98p. 1.5kg of own-brand carrots (same level) were £1. (My mum spotted this last week so I was looking out for it.)

- 1kg of own-brand sod-the-peasants demerara sugar was £1.55. 1kg of branded Fairtrade demerara sugar was £1.50.

- Similarly, a 1kg jar of organic, fairtrade own-brand hot chocolate was nearly half the price of some non-organic, non-fairtrade branded stuff — that’s a lot of money for just a name on the jar.

- Some breakfast muffins were on the reduced for quick sale shelf – apparently 40p reduced to 39p. Super-saving! ;)

- A few weeks ago, I got some discounted-for-quick-sale cat treats at Home Bargain for 29p and the cats (and dog) love them – they were basically strips of dried meat, not too much crap. John asked about buying more of them and we saw them at the supermarket yesterday – they cost £1.50 a pack, equal to £15.30 a kg. You could buy fresh steak for less than that! I think we’ll make homemade dried treats for them as well as the dog…

We felt like we were being quite conservative – applying the “no spend” ethos to unessentials – but the bill ended up being more than normal. We did buy 5.5kg of flour, nearly a year’s supply of stock cubes/bouillon (to supplement stuff we make at home – they were on offer and are something we always forget to … stock up on), £12 worth of sausages (mostly long-lasting chorizo for cooking & lunches and Polish kabanos), two months worth of decaff Earl Grey, and some household supplies we’d usually get elsewhere – but it was still strangely high. The shape of things to come? Sigh.

Read More