Spending in no spend week: week 2

I’m having an extended no spend week – starting a fortnight ago, lasting until the end of the year. It was a bit of an impromptu decision to start but I’ve found it very interesting, and these weekly summaries very useful. I’m going to continue tracking spending like this in the new year, but probably off line rather than on here all the time.

Lily-dog has been the cause of most of my expenses one way or another this week – she had a spot of food poisoning. Pets are expensive, there is no doubt about that, but for me, they’re worth it. If I could only have one luxury in life, it would be them.

This week’s spending:

- £6.20 at the laundrette washing and drying our duvet after Lily threw up a lake of vomit onto it one night – hurrah for machine washable duvets! It wouldn’t fit into our washing machine though – and even if it had fitted inside, the water inlet was frozen shut so I had to take all the bedding to the laundrette. It would have £11 for a service wash (which would have had it ready within 48hrs) but it only took an hour so wasn’t worth the extra cash. Like the boiler last week, this one was a not-quite-an-emergency but something that would have to be looked at sooner or later, would be more difficult next week and would make our lives a little more difficult (colder!) in the meantime.

- £56.55 at the vets with Lily. By Tuesday, she was into day four of the poops – much brighter in herself and running around more but still poopy – so we decide it would be best to get her checked for obstructions etc before it got into the Christmas period – when vets would be harder and more expensive to visit. While clearly improving, she was still running a temperature so the vet advised to go for some antibiotics & a sensitive-belly diet. Both helped a lot and she’s fine and dandy again now.

- £12 on a meal out with friends on Friday night. Curry + naan + rice + tarka daal = mmm. Like last week’s spending in the pub, it was a socialising expense – a group of us who usually have curries together including a few people we hadn’t seen in a while.

- I also had fish & chips last Monday lunchtime but John & Strowger bought that for me. ;)

From my exceptions:

- £64.86 on two bags of 15kg dog food (a special type of food, her normal stuff not sensitive stuff though and it’ll last 3 months) – again, if I’d planned to have a no spend period, I’d probably have bought this in advance but I didn’t so didn’t.

- Fresh food top up at the supermarket – mostly meats & cheese to cook with over the long weekend, more than normal as we had guests for two days.

I thought I’d spend money on bus fares but was feeling ill so didn’t go to a rehearsal.

My biggest temptation this week has been all the starting early January sales – lots of “save up to 50%!!!” emails dropping into my inbox. I’m using them as a reminder to unsubscribe from their mailing lists.

I also finished reading a wonderfully delightful book (Good evening Mrs Craven and other war time stories by Mollie Panter-Downes) and wanted to read more of her work – but instead of just buying it, I started a list of books to look out for – to buy new, find used or borrow at some later time.

Just a few days left of my no spend “week” now. I’m trying to decide how to incorporate conscious no spending periods into my life… What do you do? A no spend day each week? Regularly no spend days? Limited budget? Limited transactions?

Read MoreBaking bread in the winter – how do you do it?

We’ve got out of the swing of baking bread recently – partly due to general winter lethargy and partly due to the fact that we’d struggle to get yeast do its thing.

We’ve got out of the swing of baking bread recently – partly due to general winter lethargy and partly due to the fact that we’d struggle to get yeast do its thing.

It would be very difficult to grow a slow rise bread – one that needs a good 12-18 hours to rise. With our woodburners in the office & living room, we get a room temperature of 16-18C (60-65F) for a few hours during the day but for the rest of the time, it is much lower than that. The kitchen is poorly insulated (it’s an addition away from the main body of the house with lots of windows and a hard-to-insulate flat roof) so has frequently been see-your-breath chilly (especially last week when the central heating was out and it was even colder than normal). Opinions differ on the ideal temperature for yeast activity but it’s typically seen as 25-35C (75-95C) – we don’t even come close to that. (Admittedly we rarely come close to that even at the height of summer but it’s warmer, and more consistently warmer, than it is now.)

I’m loathed to use the (electric) oven as a warming box – not only would it be using energy, it would need a lot of management – turning it on and off – since the temperature setting doesn’t go anywhere near low enough for the oven thermostat to manage it. And 12-18 hours of that sort of management isn’t realistic.

Lethargy aside, we would like to get back into baking bread ASAP – it would save a lot of frozen-faced walks to the shop and, of course, shops are going to be closed over the next couple of weekends anyway/out of stock because of snow issues.

We could possibly manage some shorter rise time breads when a woodburning is running – leaving them for longer to account for it still being a bit cool – or even, if I had to do it, in the oven. That’s not out of the question, I’m just a sucker for slow rise bread: I haven’t perfected a non-slow rise loaf recipe yet and I suspect now might not be the time to work on one!

Are you still baking bread at the moment? How are you managing? Have you got any suggestions for things I could try? Or got a fool proof pretty-quick-rising loaf recipe?

Read MoreSpending during no spend week: week 1

A little background in case you’ve not seen my earlier post: I’m having a no spend “week” – well, a no spend fortnight+, until the end of the year. It was an impromptu idea – I often have no spend days, probably even weeks, without really noticing it but I wanted to have a conscious “no spend” period – and to come at it without any planning/organising has been interesting indeed!

Aside from my acknowledged exceptions (food-to-cook-at-home, food/vets for animals, essential bills, some bus fares and one birthday present), I have spent some money:

- £3.35 on posting a package to my mum. It wasn’t time sensitive – it didn’t have to be there by a certain point or anything – so it could have waited until after my no spend period. But it seems silly to be waiting just on the principle when I would be sending it either way (it’s not like I’d change my mind about sending it like I might about buying something). Equally, the item – a vintage music box I found in a charity shop, matching one my mum already has – could easily have been sent a couple of weeks earlier if I’d been more organised/planned my no spend week better. I could have easily not sent it but I think the important thing is that I took time to consider whether or not to send it rather than just acting without thinking.

- £292 on getting our central heating/hot water boiler fixed and serviced. Sigh. (Strictly speaking, John paid for this, not me, but I wanted to mention it anyway.) It stopped working on Sunday and was finally fixed on Saturday – six days without heat was beginning to make the house feel very cold and damp (our woodburners provide heat in the living room & office but aren’t big enough to heat the whole house). Given it’s the middle of winter, it was more a necessity than a frivolous want – and if we waited, it would have got harder and more expensive to fix over Xmas and New Year. (I’m going to write a post on this soon because it taught us an important, expensive lesson.)

- £3.24 on drinks at the pub on Saturday afternoon. A bit of a frivolous spend this one but it was a social occasion – meeting some people we’d been meaning to meet up with for *ages*. John was going to buy them but I was closer to the bar so I went.

From my exceptions list, I bought the birthday present, spent £4.30 on bus fare and we went to the supermarket for our monthly shop.

This is obviously quite a lot of spending during a no spend week! But it did work to strength my willpower while I was looking for the birthday present. I went into both clothes shops and bookshops while buying it – two key temptation areas for me – but I stayed focused and only looked at the category of things I was likely to buy for my friend, not stuff in general and certainly nothing for me. I also avoided charity shops and bargain shops to avoid the temptation. If I hadn’t been “no spend”ing, I could have easily have spent £50+ at those shops without really wanting or needing to – or even really noticing!

The “no spend” rule has also kept me away from online shopping – I’ve had several “I could just check eBay for that” moments regarding books, curtains and other random things, but I’ve resisted. I’ve also resisted temptation of sale offer emails from shops I like – and unsubscribed from those marketing lists.

We ate out on Thursday night – John’s company’s December meal (which they paid for) – but aside from that, haven’t eaten out or had any take-out. We had talked about having lunch at the pub on Saturday but instead had a bigger breakfast and didn’t need to eat again until we got back.

I’m going to keep going to the end of the year – so another ten days of no spending. From the exceptions list, I’d imagine I’ll need to spend a little on fresh food this week, buy a bag of dog food (which lasts 6 weeks), possibly some money on vet bills (Lily-dog is poorly at the moment – hope it’s just a bug) and a return bus fare to a rehearsal tomorrow night. Hopefully that’ll be it though!

Read MoreWhy are you frugal? Poll update

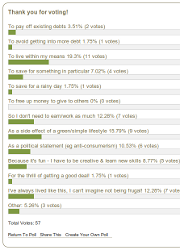

A couple of weeks ago, I set up poll asking what drives people’s frugality.

A couple of weeks ago, I set up poll asking what drives people’s frugality.

Part of the reason I asked is because a lot of frugal living blogs/personal finance sites are really focused around paying off debt. People detail their debts and progress in paying them off in their signatures on every comment/forum post – most of them are well in five figures and one person I saw talked about having US$1million of debt (!!). But that’s not why I’m frugal – and it’s not why a lot of people I know are frugal – so I wondered what it else it could be.

As of this morning, most people who voted were pro-actively frugal – just over 20% of people said they were either frugal to live within their means or to avoid getting into more debt, and just under 9% in order to save for something, mostly something in particular. Only 3.5% of people were doing it to pay off existing debt.

Adding to the proactively frugal number, over 26% are frugal as a side effect of living a simple/green life or for other political/philosophical reasons (such as anti-consumerism or stuff minimalisation), and another 12% said they were frugal so they didn’t have to work/earn as much.

Over 10% said they actively enjoy being frugal – mostly that they have to be creative and learn new skills to live on a tight budget. And another 12% said they’d always been frugal and couldn’t imagine living any other way.

I realise that the results are not necessarily representative of the population at large, even the frugal population at large, just a selection of the people who read this blog and took the time to vote, but I find it interesting all the same. We hear so much about debt – not just when on the personal finance sites I mentioned above but in the media – that it’s good to hear that not everyone is rampantly spending with free abandon.

Thanks to everyone who voted!

Read MoreThings I spotted at the supermarket

Yes, I know I’m having a no spend week/fortnight+ at the moment but one of my exceptions was food because it was an impromptu decision not to spend anything and I knew we’d be off to the supermarket this week for our once-monthly shop. If I’d planned the week more, we’d have gone last week but we didn’t really want to leave it any later than this week because it’ll be crazy busy next week and the week after.

Yes, I know I’m having a no spend week/fortnight+ at the moment but one of my exceptions was food because it was an impromptu decision not to spend anything and I knew we’d be off to the supermarket this week for our once-monthly shop. If I’d planned the week more, we’d have gone last week but we didn’t really want to leave it any later than this week because it’ll be crazy busy next week and the week after.

So, anyway, during our visit to the supermarket last night, I spotted the following things:

- 1kg of their normal (not best or basic) own-brand carrots cost 98p. 1.5kg of own-brand carrots (same level) were £1. (My mum spotted this last week so I was looking out for it.)

- 1kg of own-brand sod-the-peasants demerara sugar was £1.55. 1kg of branded Fairtrade demerara sugar was £1.50.

- Similarly, a 1kg jar of organic, fairtrade own-brand hot chocolate was nearly half the price of some non-organic, non-fairtrade branded stuff — that’s a lot of money for just a name on the jar.

- Some breakfast muffins were on the reduced for quick sale shelf – apparently 40p reduced to 39p. Super-saving! ;)

- A few weeks ago, I got some discounted-for-quick-sale cat treats at Home Bargain for 29p and the cats (and dog) love them – they were basically strips of dried meat, not too much crap. John asked about buying more of them and we saw them at the supermarket yesterday – they cost £1.50 a pack, equal to £15.30 a kg. You could buy fresh steak for less than that! I think we’ll make homemade dried treats for them as well as the dog…

We felt like we were being quite conservative – applying the “no spend” ethos to unessentials – but the bill ended up being more than normal. We did buy 5.5kg of flour, nearly a year’s supply of stock cubes/bouillon (to supplement stuff we make at home – they were on offer and are something we always forget to … stock up on), £12 worth of sausages (mostly long-lasting chorizo for cooking & lunches and Polish kabanos), two months worth of decaff Earl Grey, and some household supplies we’d usually get elsewhere – but it was still strangely high. The shape of things to come? Sigh.

Read MoreNo spend week – removing my credit card from Amazon & Paypal

The other day, I had one of those slap-forehead moments – I realised it’s far too easy for me to buy stuff on Amazon and Paypal. It’s one of the things that sparked off my impromptu no-spend week.

My credit card details are saved on both so I don’t even have to stand up and get my card, just click and done, money spent.

On other shops, where I can’t pay with Paypal, there is a lot longer consideration time. I’ll add stuff to basket then tell myself I’ll fetch my purse in a few minutes when I get up to wee or let the dog out, then the few minutes becomes a couple of hours and the excitement of buying the item has dissipated and instead of getting my card details, I close the browser window and the money is saved.

John often talks about delaying all purchases for a week after initial “ooh” – making a little program that stops you completing a transaction in one go and forces you to go away for a few days and think about it. I suspect we’d buy a whole lot less stuff if we did that – but in the meantime, removing my credit card details from Amazon & Paypal is a good start.

(While I was there doing that, I’ve also changed my “email notification” settings on Amazon so they’ll stop spamming me with “check out this awesome offer” adverts every few days. Since I hate adverts and freely unsubscribe from everything, I’m not sure why I didn’t do that sooner either!)

Read More